SALZGITTER, Germany — Volkswagen has begun producing battery cells at its first European gigafactory, a milestone that underscores the automaker’s effort to bring one of the most critical components of electric vehicles under its own control.

The facility, operated by Volkswagen’s battery subsidiary PowerCo, has started manufacturing so-called Unified Cells in Salzgitter, a historic industrial site in northern Germany. The initial output uses nickel-manganese-cobalt (NMC) chemistry and is being supplied to Volkswagen Group brands for vehicle testing. Series production is scheduled to start in 2026, initially serving new models in the group’s planned “Electric Urban Car” lineup from Volkswagen, Škoda and Cupra.

A Strategic Bet on Scale and Standardization

Volkswagen executives have described the Unified Cell as the backbone of the company’s future battery strategy. Built on a standardized architecture, the cell is designed to support multiple chemistries — including lower-cost lithium iron phosphate (LFP) and, eventually, solid-state batteries — while allowing the company to achieve economies of scale.

In the long term, PowerCo is expected to supply roughly half of the Volkswagen Group’s total battery cell demand, reducing reliance on Asian suppliers and insulating the company from geopolitical and market volatility. German industry officials have welcomed the move as a step toward strengthening Europe’s battery ecosystem, which has lagged behind China in capacity and cost.

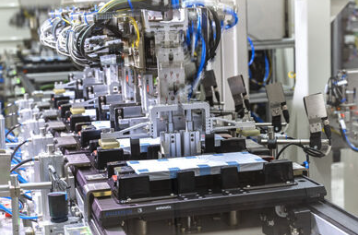

Capacity Growth and Automation

During its first expansion phase, the Salzgitter plant’s annual capacity is set to rise gradually to 20 gigawatt-hours, enough to power hundreds of thousands of small electric cars. A second phase would double that figure to 40 gigawatt-hours. Volkswagen says the factory relies heavily on automation, real-time data monitoring and artificial-intelligence-supported controls to maintain quality and efficiency.

International analysts view the emphasis on automation as essential if European manufacturers hope to compete with lower-cost producers in China. Some caution, however, that execution risks remain high, particularly as battery technology continues to evolve rapidly.

A Blueprint for Europe and Beyond

Volkswagen has positioned Salzgitter as a reference plant for future PowerCo factories planned in Valencia, Spain, and St. Thomas, Canada. Alongside cell production, the company is expanding a development center at the German site, reinforcing its role as a hub for battery research and industrialization. A new test field is expected to open in early 2026.

For policymakers in Germany and across the European Union, the project has taken on symbolic weight. It reflects broader efforts to localize clean-technology supply chains and protect the competitiveness of Europe’s automotive sector as the global transition to electric vehicles accelerates.

Whether Volkswagen’s bet on in-house, standardized battery cells will deliver the promised cost savings and technological flexibility remains an open question. But the first cells rolling out of Salzgitter mark a decisive step in the company’s attempt to reshape its future — and Europe’s — in the electric age. (hb)

Source: Volkswagen, Photos: Volkswagen