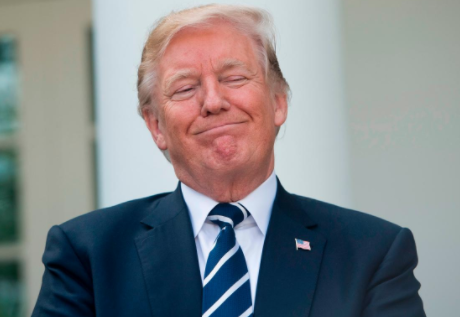

Washington/Beijing – President Donald Trump will announce tariffs on Chinese imports on Thursday, a White House official said, in a move aimed at curbing theft of U.S. technology that is likely to trigger retaliation from Beijing and stoke fears of a global trade war.

There was no indication of the size and the scope of tariffs, which U.S. Trade Representative Robert Lighthizer said on Wednesday would target China’s high technology sector and which could also include restrictions on Chinese investments in the United States. Other sectors like apparel could also be hit.

“Tomorrow the president will announce the actions he has decided to take based on USTR’s 301 investigation into China’s state-led, market-distorting efforts to force, pressure, and steal U.S. technologies and intellectual property,” the official said.

The investigation undertaken by the United States under the Section 301 of the 1974 Trade Act has identified theft from and coercion of U.S. companies to disclose their intellectual property as well as purchases by Chinese state funds of U.S. companies for their technology knowledge.

Lighthizer told the House of Representatives Ways and Means Committee, a top economic body, that the aim would be to minimize the impact of any tariffs on U.S. consumers.

China has threatened to retaliate by hitting U.S. agricultural exports if tariffs on Chinese imports worth up to $60 billion are announced by Washington.

“The remedies, in my judgment at least, would be one, doing something on the tariff front, and two, doing something on the investment front, and then perhaps other things,” Lighthizer, a lawyer and veteran trade negotiator said.

The United States runs a hefty trade deficit with China of $375 billion, caused largely by its savings deficit and rising budget deficit. Estimates of the cost of counterfeit goods, pirated software, and theft of trade secrets and could be as high as $600 billion, according to one influential study.

Talk of a global trade war emerged earlier this month when Trump announced hefty tariffs on steel and aluminum imports, aimed at hitting Chinese over-production, but which also hit key allies like Canada, Mexico and the European Union.

Lighthizer conceded that China would likely hit back with measures on U.S. agricultural exports, particularly soybeans, and said if that happened, Washington would impose “counter-measures”, although he said that “nobody wins from a trade war”, a stance that appeared to put him at odds with Trump who has termed trade wars “good and easy to win”.

Since taking office, Trump has taken a hard line on trade, tearing up a 14-nation Pacific trade pact, threatening to pull out of the North American Free Trade Agreement with Canada and Mexico and imposing hefty steel and aluminum tariffs.

He has also attacked Germany, saying that it hides behind tariffs to win an export advantage for its car industry.

The administration has been forced to walk back on some of its steel and aluminum measures, granting exemptions to Canada and Mexico and entering talks with the European Union and others to discuss potential exemptions.

CHINA STEELS ITSELF FOR RESPONSE

China has already identified agriculture as a U.S. weak point and has said it would target soybeans, a $14 billion a year business. America’s farm states heavily backed Trump in his presidential election win.

“China does not want to fight a trade war with anyone. But if anyone forces us to fight one, we will neither be scared nor hide,” Foreign Ministry spokeswoman Hua Chunying said.

“If, in the end, the United States takes actions that harm China’s interests then China will have to take resolute and necessary steps to respond to protect our legitimate interests.”

The European Union’s response to the threat of steel and aluminum tariffs also targeted areas where Republicans are vulnerable, threatening Harley Davidson motorcycles which are made in House Speaker Paul Ryan’s home state of Wisconsin.

While China has stepped up its rhetoric, it is far from clear that Beijing is ready to take the next step and move to an economic confrontation that would pit the world’s two leading economic powers against each other.

Financial markets reacted to the Trump steel and aluminum tariffs with an initial sharp selloff, although they have since regained their poise.

A global trade war would have much harsher economic consequences, possibly hitting the dollar, U.S. stock markets and currencies as varied as the Mexican Peso and the Australian dollar, according to analysis from investment bank Morgan Stanley.

A targeted use of Section 301 of the 1974 U.S. Trade Act by Washington that covered $60 billion of Chinese high tech products could see a response from China that is relatively muted, the bank said in a report, with agriculture and transport equipment being hit in return,

“This would have a moderate impact on growth in both the U.S. and China,” it said. The risk of an escalation in which there were a broad-based tariff across a range of Chinese goods followed by a response from Beijing that was commensurate with this would cause a hit to U.S. and Chinese growth, a rise in U.S. inflation and possibly prompt China to take domestic action to boost growth.

It would also hit global supply chains hard as it said that 43 percent of China’s overall exports are exports by multinational companies. Source: Reuters