WASHINGTON/HANOI – The US is urging Vietnam to lessen its reliance on Chinese tech in devices assembled locally—such as Apple iPhones, Samsung smartphones, and Meta/Google VR headsets—exported to the American market. Hanoi is hosting meetings with domestic manufacturers to boost local supply chains, yet firms warn they need substantial time and technological investment.

A Washington “tough” position demands a comprehensive overhaul: reducing Chinese component content, curbing origin-label evasion, and expanding US-made inputs.

Tariff Deadline Approaches

The Trump Administration has threatened reciprocal tariffs of up to 46 % on Vietnam-made exports effective July 8 unless Hanoi meets US conditions. Talks, including a third round in Washington from June 9–12, showed promise—but no deal yet.

Vietnam’s Trade Minister Nguyen Hong Dien and US Commerce Secretary Howard Lutnick are scheduled for further virtual negotiations to bridge gaps.

Economic Consequences and Industry Response

Vietnam’s trade surplus with the US swelled to $12.2 b in May—a 42 % year‑on‑year rise—while imports from China reached a post‑pandemic peak of $16.2 b. Last year, Vietnam imported $44 b in tech goods from China (≈30 % of total imports) and exported $33 b to the US (≈28 % of exports).

American firms like Apple, Intel and Nike rely heavily on Vietnam’s “China‑plus‑one” strategy. The American Chamber in Hanoi warns heavy tariffs could damage US investments and bilateral ties (ft.com).

Implementation Barriers

Vietnamese exporters assert that “instant changes would destroy business.” Experts note that building a supply chain of China’s sophistication would take 15–20 years—even if Vietnam is “catching up fast” in areas like electronics and textiles.

Moreover, an accelerated shift risks straining Vietnam–China relations—a complex diplomatic balance given China’s status as both investor and regional power .

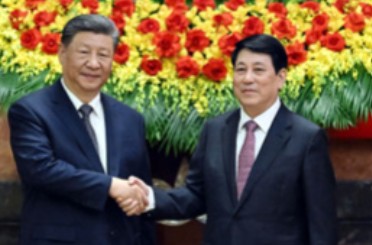

Diplomatic Developments

General Secretary Tô Lâm of Vietnam plans to meet President Trump in late June in Washington to advance trade and technology talks, though details are pending confirmation.

Meanwhile, Hanoi has begun cracking down on mislabelled “Made in Vietnam” Chinese imports. It’s also expressed willingness to cut non-tariff barriers and increase US-origin imports—as part of broader concessions.

Vietnam economic growth at stake

With the July 8 deadline approaching, balancing rapid decoupling from Chinese components against preserving export stability and geopolitical relationships poses a significant challenge. Ongoing bilateral talks and high‑level diplomacy will determine whether Vietnam can pivot its tech supply chains swiftly—or face punitive tariffs that could upend its export‑driven growth. (zai)