LIAOING, China – China says it has uncovered its largest gold deposit in more than seven decades — a vast ore body in the hills of Liaoning Province that, if proven and fully exploitable, could reshape the country’s resource landscape.

According to the Ministry of Natural Resources, the Dadonggou deposit contains roughly 1,444 tons of gold embedded in 2.586 million tons of ore, a volume that places the site among the world’s largest recent discoveries.

But behind the celebratory headlines lie questions — about feasibility, cost, and the opaque nature of China’s resource reporting.

More Rock Than Gold

The deposit is vast in volume but low in grade: each ton of rock contains only 0.56 grams of gold on average. For mining specialists, this figure is significant.

Low-grade deposits require enormous processing facilities, high energy consumption, and substantial upfront investment. “Scale can compensate for grade, but only if costs, infrastructure, and metallurgy align perfectly,” one Western mining consultant said.

There is, as yet, no independent confirmation of the deposit’s true yield or economic viability.

A Region Hungry for Growth

For China, Liaoning is more than a geological site — it is a political project. The country’s northeast, once its industrial heartland, has suffered two decades of decline, prompting successive governments to promise revitalization.

State media have framed the gold discovery as both an economic opportunity and a symbolic turning point. The planned investment through 2027 includes not only mining operations, but also refineries and downstream industries.

The message is consistent: development, rejuvenation, national achievement.

Skepticism in the West

Outside China, the reaction has been noticeably cooler.

Western outlets report the headline figures but underscore that low-grade deposits often overpromise. Many highlight China’s strategic interest in expanding its gold reserves at a time of global uncertainty, rising gold prices, and intensifying geopolitical competition.

Analysts caution that the true test will come not from press releases, but from production — and profitability.

“For now, it’s an exploration result, not a producing mine,” said a European commodities economist.

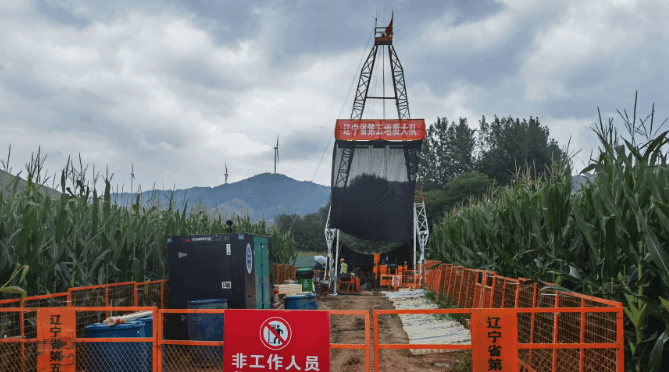

Photo: Ministry of Natural Resources

The Global Context

Gold prices have surged in recent years, fueled by central bank buying — China included — and by investors seeking safety amid geopolitical shocks.

A deposit of this size, if developed efficiently, could eventually influence China’s domestic gold supply and, indirectly, the global market. But that scenario remains years away, and dependent on factors that Beijing has not yet disclosed: environmental assessments, infrastructure spending, and the economics of low-grade ore.

Below the Headlines, Unanswered Questions

The Dadonggou discovery is undeniably large. It may someday become one of China’s most significant mines. But the story, for now, is as much about uncertainty as it is about abundance.

China has announced a treasure in the ground.

Whether it becomes treasure in hand — or remains rock with a sheen of optimism — is a question only time, and transparency, will answer. (zai)